Electronic driving logbook

A domestic, tax-authority-approved driving logbook now available at an affordable price! Since 2009, our trusted software and services have helped Finnish companies save time and stay compliant, letting you focus on what matters most.

Affordable and easy-to-use service

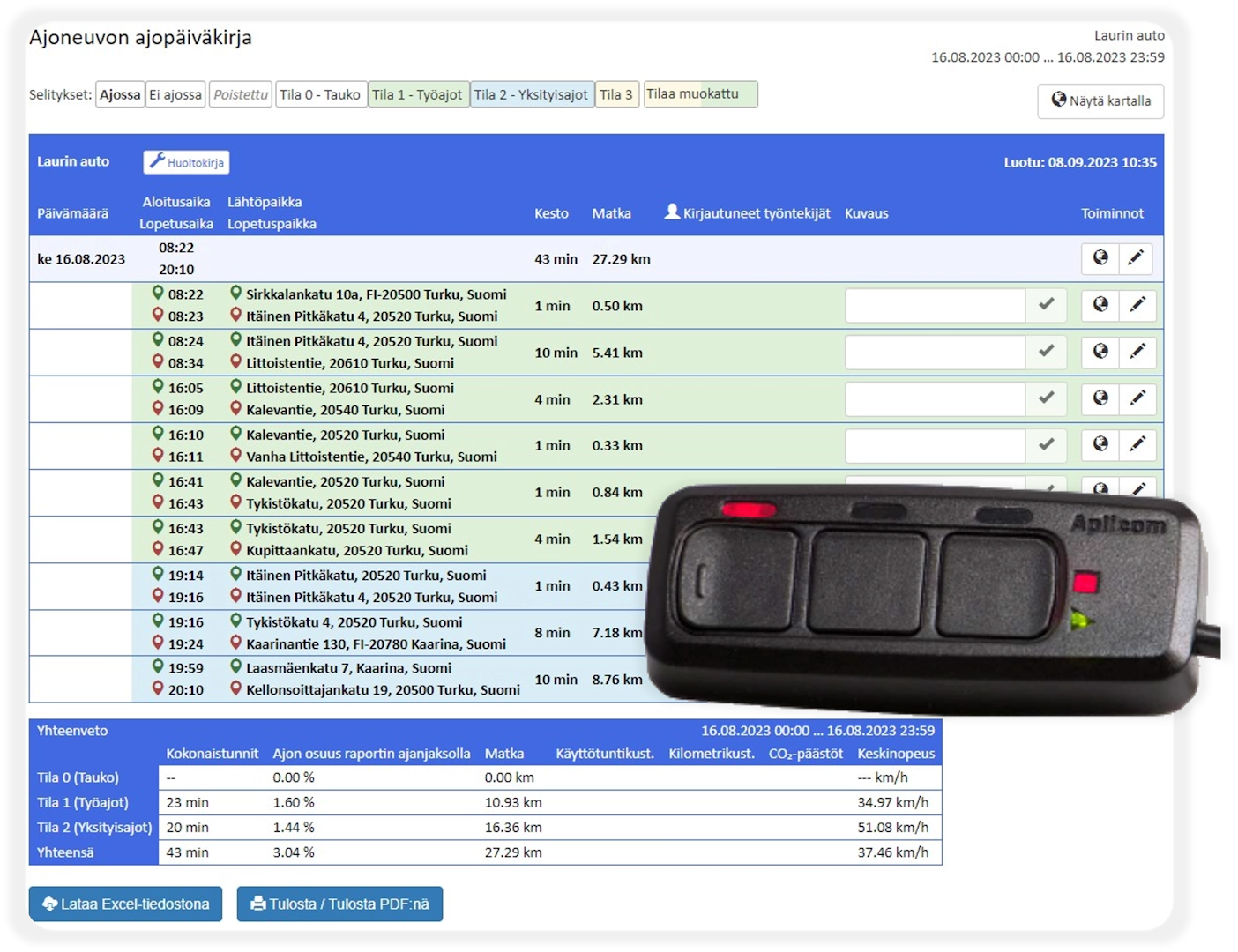

The Navicom driving log service automatically records all your trips into an electronic driving log. If necessary, trip descriptions can be easily attached to all trips. Any private trips are subsequently separated in the web application. The driving log can be saved as a PDF or Excel file with a single click.

Upon commissioning, you will receive a GPS vehicle tracker and service credentials for the Navisystem web application. The service is ready to use. Once the tracker is connected to the vehicle, it immediately starts recording an automatic driving log of all trips. After commissioning, you no longer need to manually record trips on paper or in Excel.

eDriving logbook+ The additional service includes the use of selection buttons to distinguish between work and private driving while driving, as well as driver identification. Fill out the contact form and our sales representatives will provide you with an offer.

Fill in the contact form

I am interested in the Navi-eDriving Logbook service that meets the requirements of the tax authorities.

When you order from us, you know what you're getting.

Watch the video to see how easily you can print your driving logbook for the tax authorities.

Automatically collect your trips using the Navi-eDriving Log service. Easily download your tax-approved driving log to your computer from the online service.

Convenient separation of work and private trips with selection buttons

If you use a vehicle for both work and private purposes, you should separate the journeys in your driving logbook. You can receive generous refunds if you drive fewer private journeys per year than the 18,000 km allowed by the free car benefit.

Similarly, you may have to pay back tax if the tax authorities believe that you have driven more than the permitted 18,000 km of private driving in a car with a free car benefit during the year.

Choose the locator model that suits your needs

The Navicom driving log service automatically starts recording data in the driving log when the tracker is attached to the vehicle. The electronic driving log report, approved by the tax authorities, is available at any time in your own Navisystem web application.

A locator that is very easy to connect and disconnect.

If necessary, a splitter can be used in the cigarette lighter socket, allowing you to use a navigation device or phone charger at the same time.

A tracker that is very easy to connect and disconnect. Almost all cars have an OBD connection.

This model is a functional solution if the tracker needs to be hidden and at the same time easily connected to the vehicle.

A fixed locator that connects to the battery terminals and is easy to install yourself.

A fixed locator that plugs into the fuse box and can be installed concealed.

What does the taxman require from a driving logbook?

Our Navi-eDriving Logbook service meets all the requirements of the tax authorities. The tax authorities require the following information in the driving logbook:

Saving and summarizing the report

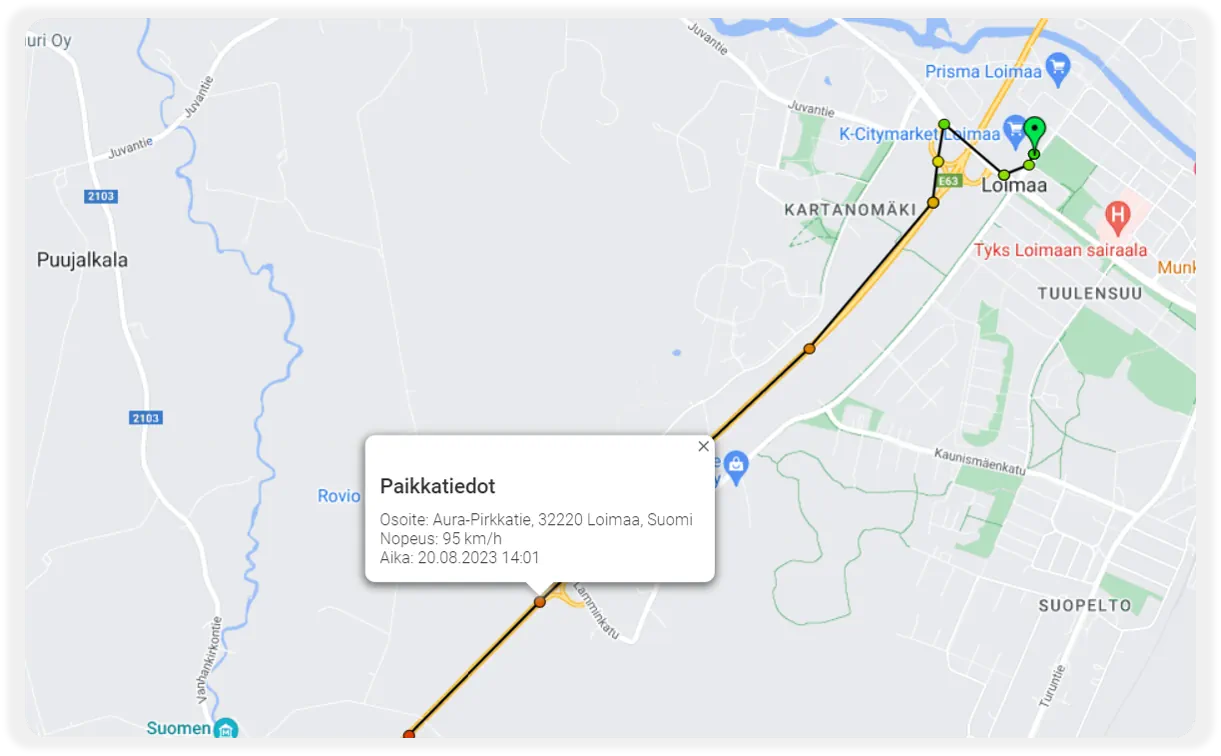

Routes and waypoints

See also

Vehicle tracking-

service

A GPS tracker installed in the car records and sends all trips to the Navisystem online service. Real-time tracking and electronic driving logs.

Real-time location information

With vehicle tracking, you always know where your company's vehicles are. You can view the location of vehicles in real time from the map view, which reduces unnecessary phone calls.

GPS tracking devices

A GPS tracking device is the most reliable way to track the movements of your company's vehicles. Our wide range of trackers guarantees excellent value for money for a variety of uses.