To the working time tracking service The investment makes work more efficient and brings clear savings in payroll and invoicing. Well-built time tracking and its support services support continuous development and growth. Investment profitability calculations help determine the procurement budget, resourcing and schedule.

The purpose of this article is to help you understand and evaluate the cost benefits of a time tracking service. At the end of the article, an example calculation of cost benefits in a construction company is presented.

How does a time tracking service save money?

1. Salary payment

The employee records their own hours and only needs to do so once. Valuable working time is saved in the office as potentially incomplete or unclear work entries recorded on timesheets no longer need to be copied to the machine. Payroll errors and so-called “pencil hours” are also reduced.

2. Invoicing

Nothing goes unbilled when all working hours, materials and supplies used are logged directly to the correct job number. Jobs can be viewed based on the current invoicing status. Once invoices have been sent, jobs are archived as invoiced. The information can be used in post-calculation and in preparing offers. In the future, services can be priced more accurately based on the information collected, and it is easier to focus on profitable jobs.

3. Work supervision

The project manager can monitor the progress of the work in real time. The work and additional information related to it are delivered directly to the relevant employees, ensuring that the right resources end up in the right place. The project manager and employees are aware of the next work steps and internal inquiries are reduced.

4. Legal obligations

The electronic system also assists in fulfilling legal obligations, as the work status of employees is available in real time. In the cloud service, the information is always at hand and up-to-date. In the event of an official inspection, the information can be accessed quickly, and problems do not arise due to incomplete information.

Example calculation

We have prepared an example calculation of the financial benefits related to payroll and invoicing in a fictional company. The employees in the example company do a lot of mobile work and the management is rarely present. We focus on payroll and invoicing in the calculation only, although in reality the system brings benefits in other areas as well, such as work management and resourcing. Please note that the benefits are always company-specific, so our example is only a guide calculation!

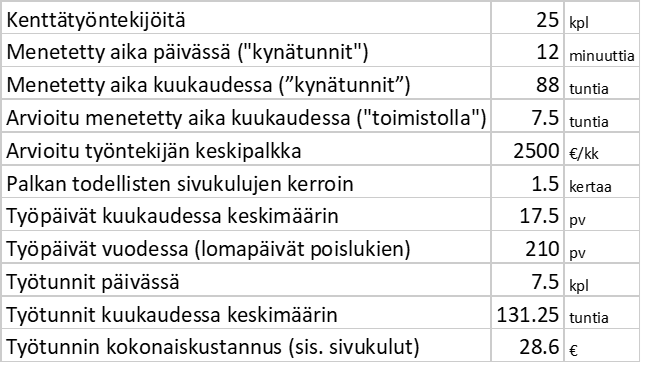

The example company is called Raimon Rakennus. The company has 25 employees. The working hours recorded on the timesheet are rounded up to an average of 12 minutes per working day (“pen hours”). In addition, an office worker spends 7.5 hours per month processing timesheets.

You can visit here looking at how the calculation is done. With an average salary of 2500 euros and 1.5 times the total overhead costs, the total costs of "pencil hours" and processing timesheets:

- per month €2,714

- per year €32,571

If, in addition, 500 euros worth of work performed is not invoiced to customers per month, this amounts to a total of 38,571 euros in annual costs.

By investing in a time tracking service, these costs can be eliminated completely. A time tracking service is an affordable investment that pays for itself quickly. Total costs of a time tracking service:

- per month approx. €100-300

- approx. €1200-3000 per year.

Prices depend on the services selected.

Are you interested? working time tracking about the acquisition? Contact us!